Transaction Readiness

A Key to Growth, Capital Efficiency, & Valuation

Keys To Maximizing Value

- Tech companies are bought-not sold

- You need to be ready when the Buyer “comes a courting”

- Strong diligence enhances seller leverage

- Capital efficiency most important to investors 2025

Buyers Really Care

- Buyer’s SWAT team descends on every aspect of business while Seller attempts to conduct business as usual

- Seller management scrambles to meet Due Diligence requests

- Battle tested, multiple deals in a month, large checklists

- Seller management scrambles to meet Due Diligence requests

- Mismatch of Buyer’s Due Diligence teams and Seller’s resources

- M&A process & execution are core competency for Buyers

- Large teams of dedicated experts

- Strategy, Finance & Operations, Legal, HR, IT

- Buyers will make own assessment of the health and hygiene of your business

- If Buyer passes, you may never know exactly what turned them off

- Buyers back away from >50% of deals during due diligence

Deadly Sin #1

Lack of Validation of Benefit to the Buyer

Validation of benefit to the Buyer

- Can you provide the evidence to support the Buyer’s business case to purchase your Company?

- Will your customers validate the value when called by Buyer…do you know what they will say?

- Is your team aligned on articulating value proposition to Buyer?

Deal Impact

- This is the first and most important hurdle

- If cannot validate business case at start, the Deal Team will report back to Business Owner that there is no “there-there”

- High probability of a Deal Killer-no second chance

Deadly Sin #2

Lack of Strategy

Due Diligence Questions

- Market Strategy

- Growth Drivers & Sizing

- Competitive Landscape

- Product

- Technology

- Customers

- Sales

- Growth & Product

- Financial Overview

- Capital Efficiency

Deal Impact

Strong business case with Buyer/Investor

- Pitch Deck that nails it

- Coherent 3 YR Strategic Roadmap with Management Alignment

- Operating Plan. Assumptions challenged & In-Sync with item 2

Deadly Sin #3

Lack of Capital Efficiency

Due Diligence Questions

- Sales Efficiency

- CAC Payback

- Upgrade Path

- Expansion Motion

- Customer Retention

- Net Retention

- Pricing

- Gross Margin

- Incorrect or insufficient resource allocation

- Incentives

- Compute Spend Mgmt

- Revenue per Headcount

- Burn Multiple

Deal Impact

- Capital Efficiency is most important to Buyer/Investor in 2025

- Operating in the “Rule of 40” and “1.5X EBITDA to 1.0X revenue” zone

Deadly Sin #4

Lack of Business Operationalization

Dynamics

- Standardization in place

- Math in place to assess performance and course correct

- Forecasting Rigor

- Operating Drills

- Streamline & Automate. “Act 30/30” Principle, save waste by 30% in a process and use it to increase revenue by 30%

- Organization. “80/20” Principle, each 80 for a project needs to have a qualified 20 to ensure the project is delivered

- “3 X 20” Principle. Have 3 options to achieve the goal

Impact

- Lack of Alignment to the Strategic Plan.

- Loss of focus and direction leading to confusion, wasted resources, increased risk, and negative impact on bottom line

- Deliver a cohesive financial plan that matches and supports the strategic plan, having challenged and validated assumptions

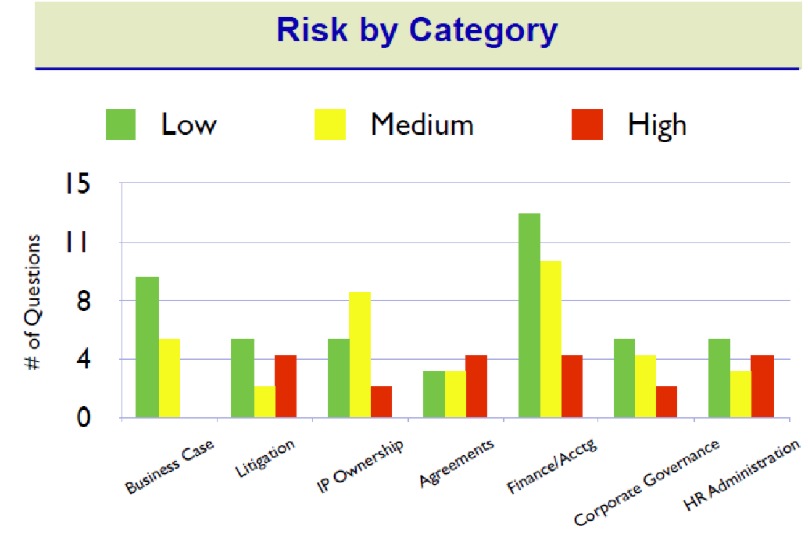

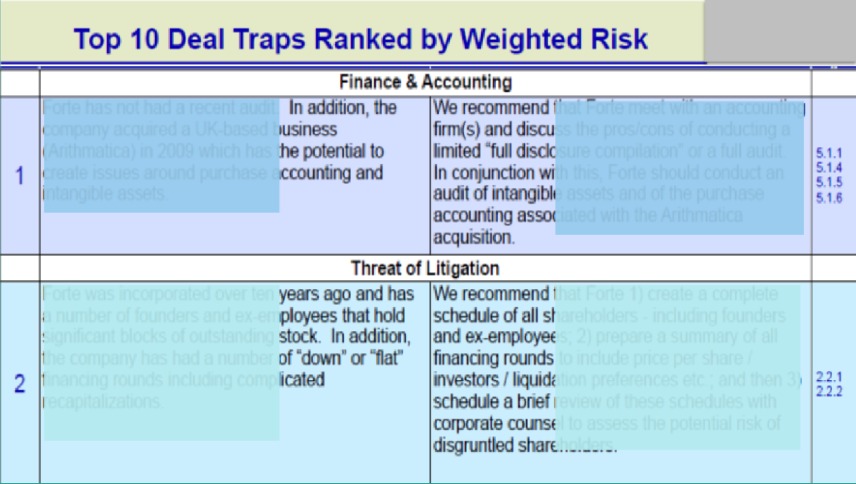

Other Deadly Sins

Deadly Sin

- Failure to Show Ownership of Intellectual Property

- Are there potential lawsuits or litigation that may surface during due diligence or once Deal is announced?

- Quality of accounting and forecasts.

- Do any of your agreements have non-standard terms (exclusivity, termination rights) that could impact the value to Buyer?

Deal Impact

- Going back to gain “permissions” or to remediate 3rd party code can be time consuming-often a Condition to Closing

- Unresolved claims will REDUCE Deal Value, either at Close or from Escrow

- Identified exposures will directly REDUCE the Deal Value

- Non-assignment or cancellation of customer contracts can reduce future revenue and reduce the value of the Deal

Transaction Readiness Services Phase 1

- Phase 1. Risk Assessment: A Holistic Strategy | Financial | Operational Review

Assesses M&A risk factors. Identify gaps in strategy, capital efficiency, and bottlenecks across teams, workflows, and systems. Recommend a course of remedial action Transaction Readiness Services

- Interviews: CEO, CRO, VP Product, CTO, CFO, FP&A etc.

- Analytics: Lakeview Advisors internal analytics

- Summary Report: Identify areas for improvement in your transaction readiness, strategic/financial plan, Org structure, financial, and operational frameworks

- Recommended Action Plan: Recommended remedial actions

Transaction Readiness Questionnaire

Transaction Readiness Services Phase 2

Phase 2. Lead/Oversee the specific implementation of the recommended remedial actions.

- The Lakeview Advisors team will supplement your FP&A/SWAT team

- Perform the specific implementation of the recommended remedial actions

- Strategic Planning Session with deep dives in the risk areas

- Implement initiatives to optimize internal financial/operational processes, Org structure, drills, workflows, automation to drive efficiencies and operational reliability